OnlyFans Quietly Out-Earned Big Tech -But Is the Model Cracking?

The Falloff of One of the Most Profitable Platforms Ever Isn’t Just a Traffic Problem — It’s a Wake-Up Call for the Future of Creator Businesses and the Tools They Need Next

Hey, Kevin here. I break down the wild (and wildly profitable) world of creator platforms—what’s booming, what’s busting, and how the money really flows.

This one's on the house. Want the full picture every week?

In 2023, OnlyFans pulled in a staggering $6.6 billion in gross revenue — more than Netflix’s $6.2B in 2014, Spotify’s $5.4B in 2020, and on par with Nvidia’s 2020 revenue. Not bad for a platform built on creator content.

What’s fueling this? A mix of steady subscription income and high-margin one-off purchases — think photos and videos bought directly from creators.

At the center of this empire is Leonid Radvinsky, who’s taken home just under $1.3 billion over the last four years as the site’s owner. That’s the kind of payday you’d expect from the founder of a unicorn tech company — not a platform best known for adult content.

OnlyFans isn’t just raking in revenue — it’s wildly profitable. In 2022, it posted a pre-tax profit margin of 48.17% (that’s $525 million in profit on $1.09 billion in revenue). Compare that to Spotify, which ran at a negative margin that year, and even Nvidia, which posted a healthy 36% margin.

And OnlyFans is doing all this with just about 1,000 employees — proving that when it comes to monetizing creator content, it’s not just about scale, it’s about efficiency.

What’s even more interesting?

This explosive growth didn’t come from massive spending or flashy tech. It was almost entirely driven by demand. People wanted the content, creators wanted a way to get paid directly — and OnlyFans happened to be the right platform at the right time.

The site’s 2019 move to openly allow adult content turned out to be a game-changer, opening the floodgates for creators and fans alike. Throw in the COVID-era spike in online content consumption, and suddenly, OnlyFans wasn’t just a niche platform — it was a cultural phenomenon. For a moment, it genuinely felt like they had cracked the code on how to make the creator economy work.

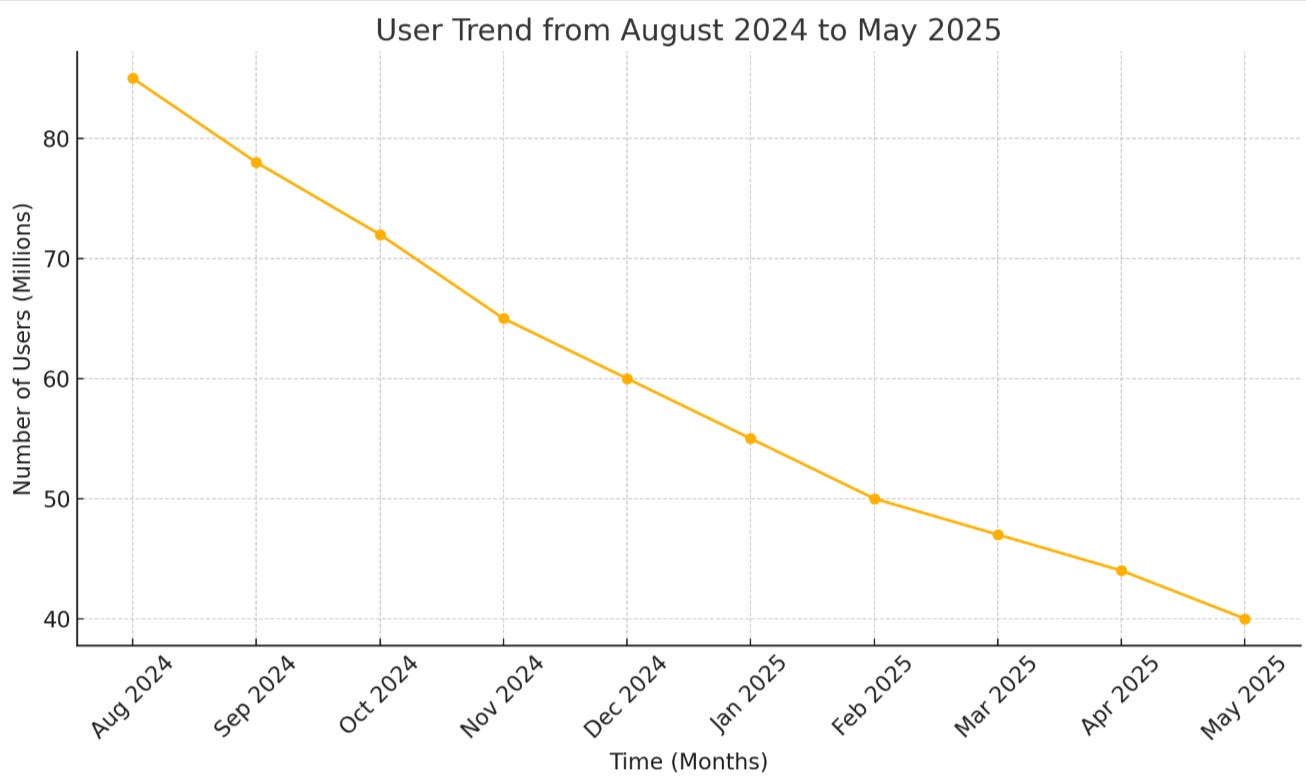

📉 The Decline: By the Numbers

In August 2024, OnlyFans reported over 85 million users, according to data from Semrush. As of May 2025, that number has dropped sharply to just 40 million. This decline has occurred in less than a year — and the trend is continuing downward as we speak. It’s a significant drop that raises serious questions about the platform’s current state and future direction.

In parallel with this user decline, Google has drastically reduced the number of organic keywords for which the OnlyFans domain ranks. Back in 2024, the platform was associated with around 960,000 keywords. By 2025, that number has plummeted to just 82,000. It’s a dramatic shift that cannot be overlooked.

While Google is a major source of traffic for many online platforms, it’s not the only one. Still, the ongoing drop in organic visibility suggests OnlyFans may be losing relevance — or perhaps users are simply choosing to engage with the platform less frequently.

Note: Traffic figures can vary between reporting tools and methodologies. The organic search drop is a specific reported event. Overall visits reflect broader trends.

🎤 Even Top Creators Are Feeling the Drop

In a viral Kick stream, Amouranth’s husband gave an unscripted rant about their income drop:

“We have a Kick contract, and we still do OnlyFans. She does, right?”

“The amount of money we make with both... has always been less than what OnlyFans alone used to make in 2022 and ’23.”

The clip, shared by @KickClipper, quickly made the rounds — and gave voice to what many creators had already been feeling behind the scenes.

The takeaway?

Even the biggest names aren’t immune to platform shifts, Google changes, and shifting fan behavior. The creator economy isn’t collapsing — but it is recalibrating.

💼 What This Means for the Business of Creator Platforms

💡 Insight #1: Big Revenue ≠ Durable Business

Before we dive deeper into what’s driving the shift in the creator economy, let’s start with the basics:

Just because a platform is printing money doesn’t mean it’s built to last.

In 2022 and 2023, OnlyFans was doing exactly that — posting industry-beating margins, raking in revenue, and looking untouchable. But as we’ve seen over and over in tech: high margins can hide shaky foundations.

Here’s what’s underneath that revenue:

🎥 They Don’t Own the Content

OnlyFans doesn’t actually own the thing people are paying for — the content. Creators do. And if those creators decide to leave (along with their audiences), they can. That makes OnlyFans more of a middleman than a moat.

Compare that to a platform like Netflix, which invests billions into its own original programming to lock in viewer loyalty. OnlyFans, by contrast, are betting that creators just... won’t leave.

That’s not a strategy — that’s a vulnerability.

🧪 Innovation? What Innovation?

For a platform generating billions, OnlyFans has been surprisingly low-tech. The product hasn’t evolved much, and according to reports, its core features haven’t seen meaningful updates in years.

While competitors pour resources into AI, personalization engines, creator analytics, and discovery tools, OnlyFans has largely coasted on existing demand. That kind of stagnation invites disruption.

Without a strong product roadmap or serious R&D investment, OnlyFans risks being leapfrogged by more agile, more creator-friendly tools.

🚫 Stigma Still Matters — A Lot

The platform’s openness to adult content fueled its growth. But that same decision has now become a glass ceiling.

Mainstream advertisers? Gone.

Big brands? Still cautious.

Institutional investors? Rarely touch it.

Some analysts estimate that the so-called “stigma discount” could slash OnlyFans’ valuation by 80% or more — even with the same financials as a comparable non-adult platform. That’s massive. And it limits everything from strategic partnerships to exit potential.

In short: the adult content advantage helped them grow, but now it’s holding them back.

🧠 Insight #2: Creator Platforms Are Built on Fragile Ground

Let’s zoom out for a second.

OnlyFans isn’t the only platform facing turbulence — it’s just the loudest current example of how fragile the creator platform model really is. And the reasons go far deeper than traffic or revenue drops. These cracks are structural.

Here’s what’s under the surface:

🚨 Growth Fueled by Attention, Not Product

Most creator platforms don’t grow because of innovative features, powerful infrastructure, or sticky user experiences.

They grow because of attention — viral moments, cultural heat, and the gravitational pull of top creators.

That’s not a product strategy — that’s riding the wave.

But waves crash.

Platforms that scale on cultural momentum — instead of building real, defensible tech — end up chasing the algorithm.

And when that algorithm shifts, or attention drifts elsewhere? The whole system shakes.

👋 Loyalty Lives With the Creator, Not the Platform

Let’s be real: fans follow creators, not logos.

When a creator moves to a new platform (or launches their own), their audience often moves with them.

That’s creator power. But for platforms? It’s a liability.

If users have no reason to stick around after their favorite creator leaves, then the platform has no retention moat.

Creator loyalty is transferable — and that means the platform never truly owns the relationship.

📉 No Cushion When Traffic Drops

Here’s the kicker: for platforms like OnlyFans, traffic = revenue.

If fewer users show up — or if they spend less — income takes a direct hit. Instantly.

There’s no buffer. No alternate business model.

No ad engine (especially in adult).

No enterprise licensing.

No B2B tools.

Just one engine — and when that stutters, the whole operation feels it.

💸 Insight #3: Monetization Power Is Moving — and It’s Not Where It Used to Be

A quiet revolution is happening in the creator economy — and it’s shifting power away from traditional platforms and toward creators themselves.

For a while, the playbook was simple:

Grow your audience → Plug into a platform (OnlyFans, Patreon, YouTube) →

Monetize through subscriptions, tips, or brand deals.

But that model?

It’s plateauing — and creators are starting to outgrow it.

🧾 Subscriptions Aren’t Dead — But They’re No Longer the Star

Yes, direct fan funding still matters. Subscriptions still pay bills.

But that golden era of “set it and forget it” passive income through platform subs? It’s cooling off — fast.

Creators are now experimenting with a broader mix:

Custom content bundles

Pay-per-view messages and exclusive drops

Tipped requests and voice content

Private chats and DM access tiers

Behind-the-scenes or live interaction perks

Why? Because creators are realizing they can’t rely solely on monthly subs to scale — especially when platform algorithms, policy shifts, or public perception can change overnight.

🛠️ The Real Action? Tools and Infrastructure

The fastest-growing part of the creator economy isn’t content itself — it’s everything that supports content.

We’re talking:

AI-powered content assistants

Workflow automation tools

Cross-platform merch and commerce systems

Advanced analytics dashboards

Flexible, creator-first payment infrastructure

Licensing and asset management platforms

Venture capital is pouring into these “picks and shovels” businesses — not because they’re flashy, but because they’re foundational.

Creators want more control, better insights, and fewer middlemen.

And finally, the tech is catching up to meet that demand.

🔁 What This All Means for Builders, Investors, and Creators

The story of OnlyFans isn’t just about one platform peaking — it’s about the entire creator economy maturing.

And the signals are loud and clear:

📉 Power is shifting

🔄 Models are evolving

🎯 Control is moving into creators’ hands

Here’s what that means — depending on where you sit in the ecosystem:

🚀 A. For Founders: Don’t Build Another Platform — Build Infrastructure

Let’s be honest: the world doesn’t need another OnlyFans, Patreon, or generic “creator marketplace.”

That land grab? It’s over.

If you’re building in the creator economy, the real opportunity is in helping creators:

Own their stack

Operate like businesses

Scale without relying on rented platforms

Start here:

Payments: Fast, global, creator-friendly payouts. Stripe’s cool — but creators need tools built specifically for them.

Analytics: Not just how many clicks — but who’s clicking, where, and how to monetize that attention across channels.

Asset Management: One dashboard to manage content across YouTube, TikTok, Instagram, OnlyFans, and more.

AI-Powered Tools: For editing, scheduling, captioning, DMs — anything that saves time and mental energy.

Commerce & Monetization: Think digital products, memberships, merch, and community platforms that scale with the creator.

Venture capital is already betting big on these “picks and shovels” — because creators aren’t just content machines anymore.

They’re mini-media empires.

Build the back office.

💰 B. For VCs: Stop Chasing Vanity Metrics — Dig Into the Stack

If you're still evaluating creator platforms by top-line GMV or revenue, you're missing the point.

OnlyFans is proof:

High revenue ≠ low risk.

What you really want to understand is:

❓ What’s the churn rate — for both creators and fans?

❓ How fragile is their traffic engine?

❓ Are they dependent on one payment processor or country?

❓ Do creators stick around because they love the product — or just because the checks haven’t bounced yet?

The next breakout success in this space won’t be another “destination” platform.

It’ll be a creator-first layer — something flexible, privacy-conscious, and embedded directly into the creator's monetization workflow.

Think:

AI tools for automating DMs, content delivery, and posting

Digital storefronts for selling content bundles outside platform limits

Message management tools to streamline fan communication

Scheduling + engagement analytics wrappers built specifically for creator workflows

This is about the creator stack — and the smartest investors are backing the tools that stitch that stack together.

🎤 C. For Creators: Diversify Everything — Then Own It

If you’re a creator reading this, here’s the one-liner to tattoo on your brain:

If you don’t own your audience, you don’t own your income.

Don’t build your entire business on one platform’s algorithm.

We’ve seen what happens when that feed turns cold — and no, it’s not just you.

Here’s what the smartest creators are doing:

💌 Build an email list: It’s not sexy — but it’s solid gold.

🌐 Launch your own site: A home for everything you do. Not a page on someone else’s platform — your own.

🧠 Build a real brand: Something fans follow across platforms. A brand that travels with you.

This isn’t about being everywhere.

It’s about being in control.

A platform can change its policy.

You can’t lose your mailing list.

Your own site won’t shadow ban you.

The strongest creators are thinking like founders now — and their businesses are stronger for it.

🧨 OnlyFans Is Still Profitable — But the Cracks Are Spreading

OnlyFans remains wildly profitable.

As of late 2023, it was still printing cash and posting impressive margins. But by 2025, the surface is starting to fracture — and the cracks are no longer subtle.

🔻 Search traffic is down sharply

💸 Top creators like Amouranth are reporting falling earnings

📉 Growth hasn’t just cooled — it’s stalled

What’s happening?

The same storm hitting the broader creator economy:

😴 Platform fatigue

🌊 Market saturation

💵 Discretionary spending pressure

🤖 Algorithm volatility

And it’s revealing something deeper — structural flaws that were always there:

OnlyFans was optimized for profit, not permanence.

It never owned the content.

It barely evolved its product.

It relied on infrastructure it couldn’t control.

And it built on a business model too stigmatized for long-term scale.

⚡ The Shift Isn’t Subtle Anymore

The creator economy isn’t collapsing. It’s transitioning — from platforms that gatekeep to ecosystems that empower.

And the momentum is now clearly behind:

Creator-owned channels — from private communities to email lists and standalone sites

Infrastructure — tools for payments, analytics, automation, rights, and reach

Smaller, tighter communities — where trust outperforms virality

Even former platform insiders are admitting it:

The future won’t be defined by the next gatekeeper — it’ll be built by the tools creators choose to own.

⚡ The Creator Economy Isn’t Dying — It’s Growing Up

The real shift isn’t a collapse — it’s a correction.

And it’s moving power in one clear direction:

From platforms → to creators

From scale → to infrastructure

From hype → to ownership

Even former execs are admitting it:

The next era won’t be dominated by gatekeepers — it’ll be built on the tools creators choose to control.

🔚 The Real Takeaway:

This isn’t about building the next platform.

It’s about building for the phase that comes after platforms peak.

If you’re creating for the creator economy in 2025, don’t just replicate what worked yesterday.

Create the infrastructure that will still matter five years from now.

💡 Building for Creators?

I’m diving deeper into the shift from platforms to infrastructure — with breakdowns on creator stacks, monetization mechanics, and what’s actually working.

If this resonated, subscribe for future drops. Or reply and share what you're building- I read every note.

Let’s push the creator economy beyond hype — and into real leverage.